Compliance & Tax Planning

MSME Company Specific

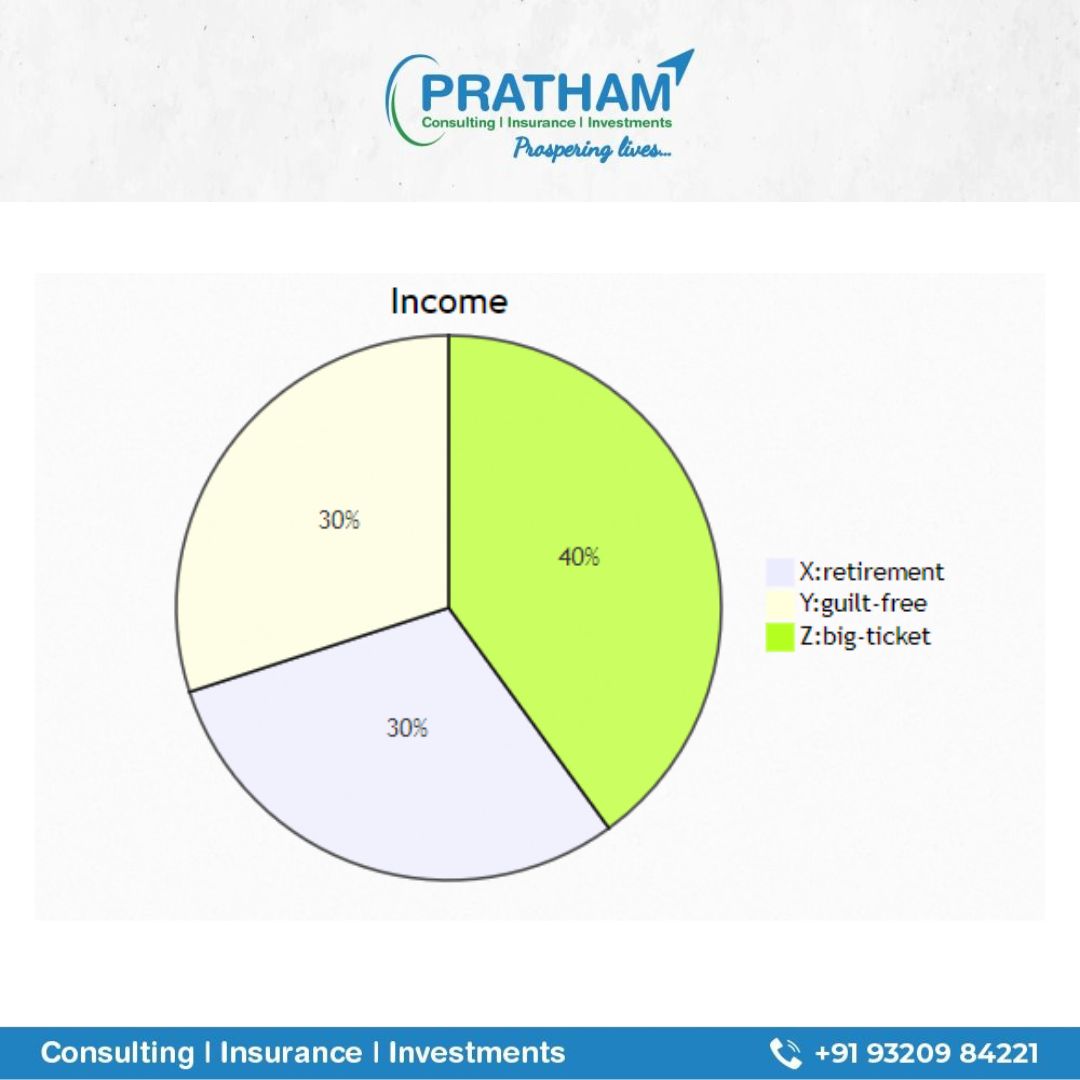

Individual Investment Solution

Individual Insurance Solution

Individual Succession Planning

Services / Solution

Compliance & Tax Planning

MSME Company Specific

Individual Investment Solution

Individual Insurance Solution

Individual Succession Planning

Services / Solution