![]()

Introduction Chanakya, the ancient Indian philosopher and economist, is renowned for his astute political strategies and profound insights into governance. However, his teachings also offer valuable lessons for modern-day investors seeking financial success. In this blog, we explore Chanakya’s enduring wisdom and its relevance to contemporary investment strategies. 1. Plan Your Course: Just as a […]

![]()

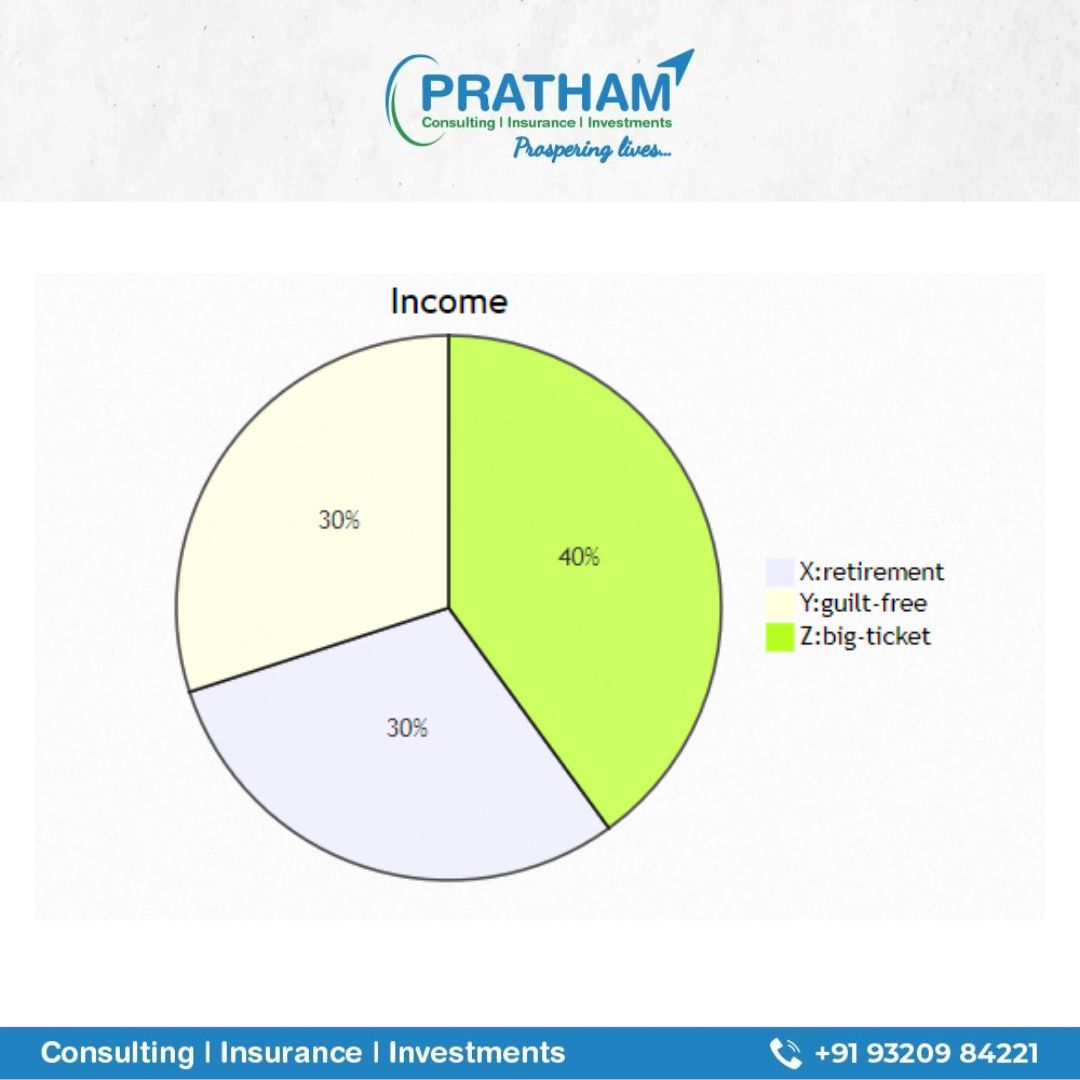

In today’s fast-paced world, managing your finances effectively is more crucial than ever. Yet, the concept of guilt-free spending often seems elusive. Many of us grapple with the dilemma of enjoying life now versus securing our future. However, with the right financial strategies, you can balance both and achieve financial freedom. Here’s how goal-based investing […]

![]()

When you’re young and in good health, it might seem like health insurance is an unnecessary expense. However, getting covered early is a smart move for several reasons: 1. More Choices: By starting your health insurance coverage now, you open the door to a wider range of plans and higher sum insured options—all at lower […]

![]()

Accidents and natural calamities can be incredibly stressful, but the process of claiming car insurance doesn’t have to add to your worries. At Pratham Services Fincorp LLP, we’re committed to guiding you through each step to ensure a smooth and hassle-free experience. Here’s a comprehensive guide to help you navigate the car insurance claim process […]

![]()

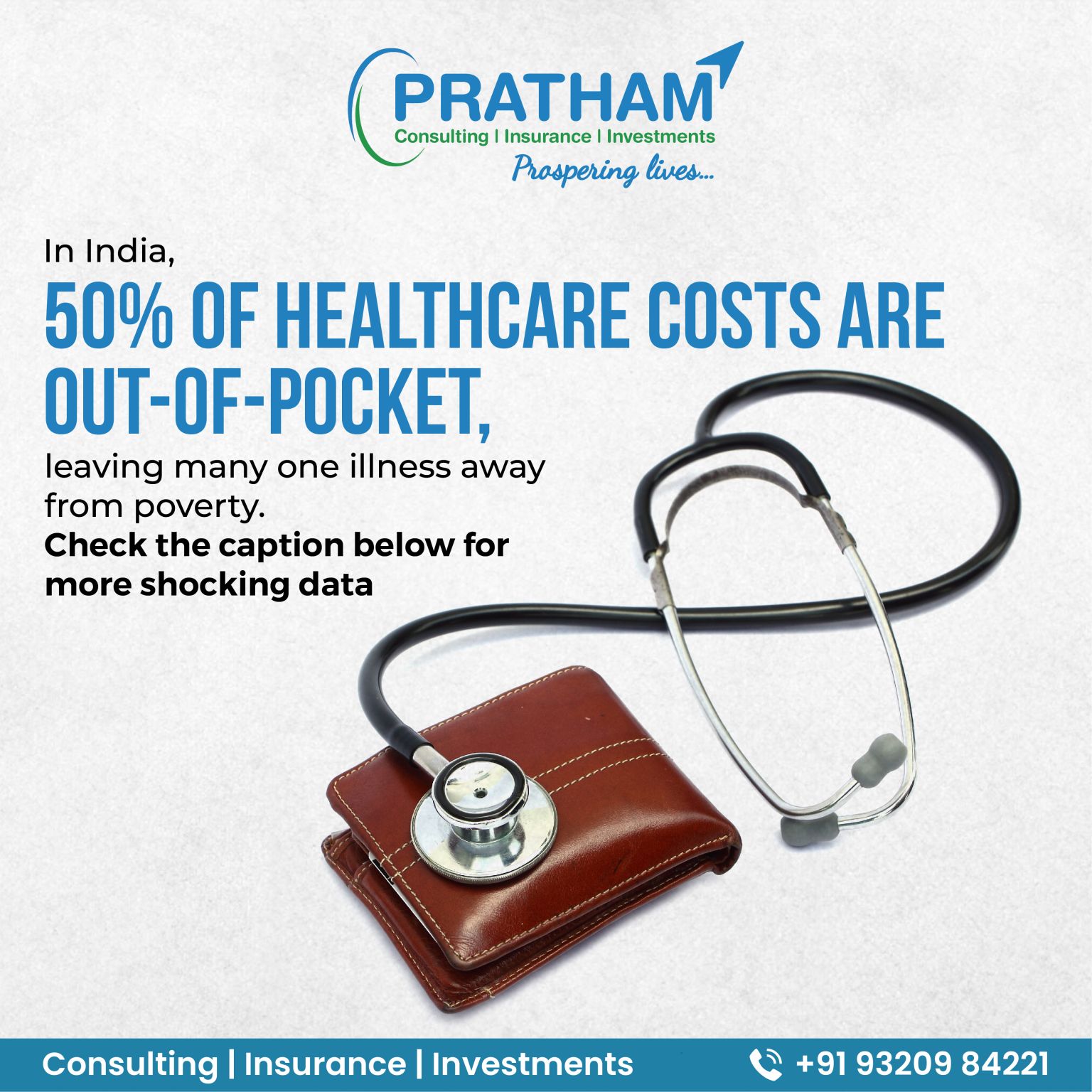

The looming shadow of unexpected medical expenses is a reality for millions of Indians. With rising healthcare costs and a growing prevalence of lifestyle diseases, the financial burden of illness can be catastrophic. The Stark Reality India is grappling with a severe healthcare crisis. Consider these alarming statistics: These figures underscore the urgent need for […]

![]()

The new financial year is here, and with it comes a familiar feeling for many – the regret of last-minute tax-saving investments. But is prioritizing tax benefits the best approach? Let’s explore why a holistic financial plan is crucial for building wealth and minimizing tax burdens. Beyond Tax Savings: Why a Balanced Approach MattersWhile saving […]

![]()

The Employees’ Provident Fund Organization (EPFO) is making things easier for its members! They’ve recently introduced auto-mode claim settlement for claims related to education, marriage, and housing. This means your claims will be processed automatically, without any human intervention, leading to much faster approvals. Here’s what you need to know: What this means for you: […]

![]()

Planning for retirement is crucial. But many people fall into common traps that can leave them financially insecure in their golden years. Here are the top 5 mistakes to avoid, along with how Pratham can help you achieve a comfortable retirement: The Top 5 Retirement Mistakes: Benefits of Retirement Planning with Pratham: How Pratham Can […]

![]()

In today’s digital age, our families are more connected than ever. While this connectivity offers numerous benefits, it also exposes us to a range of online threats. Data breaches, online scams, and identity theft are becoming increasingly common, and a cyberattack can have devastating consequences on your finances and emotional well-being. Protecting your loved ones […]

![]()

When it comes to securing their family’s future, non-resident Indians (NRIs) are increasingly turning to term insurance plans offered by Indian insurers. This preference is driven by various factors that make domestic policies more appealing than their international counterparts. Let’s explore the reasons behind this trend and why Indian term insurance plans are the go-to […]