![]()

In today’s fast-paced world, managing your finances effectively is more crucial than ever. Yet, the concept of guilt-free spending often seems elusive. Many of us grapple with the dilemma of enjoying life now versus securing our future. However, with the right financial strategies, you can balance both and achieve financial freedom. Here’s how goal-based investing can help you spend smart and live-free.

1. Spend Smart, Live Free: Unlock Guilt-Free Spending Today!

Imagine spending on the things you love without the nagging guilt of neglecting your financial future. Goal-based investing allows you to do just that. By setting clear financial goals—whether it’s saving for a home, planning a dream vacation, or building an emergency fund—you can allocate your resources efficiently. This way, you’re not just spending; you’re investing in experiences that align with your life’s objectives.

2. Invest in Your Goals—Enjoy Life Guilt-Free!

Your financial goals should be as unique as your lifestyle. With goal-based investing, you prioritize what matters most to you. Whether it’s short-term pleasures or long-term aspirations, aligning your spending with your goals ensures that every penny you spend contributes to a bigger picture. This approach not only helps you stay on track but also brings peace of mind, knowing that your future is secure.

3. How to Spend Without Guilt and Still Secure Your Future

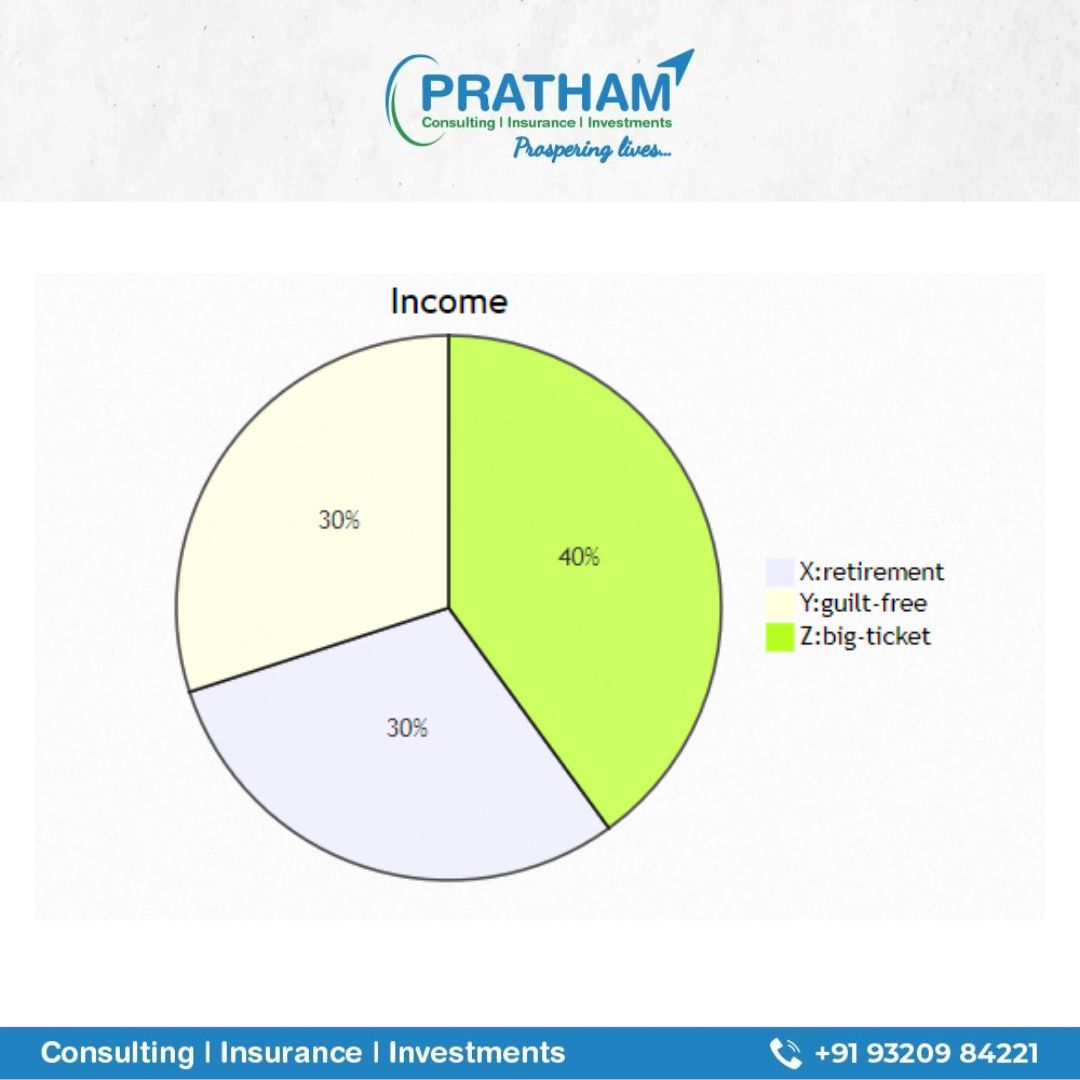

The key to guilt-free spending lies in careful planning and discipline. Start by identifying your financial goals and categorizing them into short-term, medium-term, and long-term objectives. Then, create a budget that allows for discretionary spending while ensuring you’re consistently investing in your goals. This balanced approach lets you enjoy the present without compromising your future.

4. Achieve Financial Freedom: Guilt-Free Spending Starts Here

Financial freedom isn’t just about having money; it’s about having the freedom to spend without worry. Goal-based investing empowers you to take control of your finances, ensuring that your spending habits are in harmony with your financial goals. Over time, this approach helps you build wealth, reduce financial stress, and enjoy life’s pleasures guilt-free.

5. Balance Your Goals and Spending with Ease!

Balancing your financial goals with your desire to enjoy life doesn’t have to be a struggle. By embracing goal-based investing, you can create a financial plan that accommodates both your needs and wants. This strategy allows you to spend wisely while staying on track to achieve your long-term objectives, ultimately leading to a more fulfilling and balanced life.

Conclusion

Guilt-free spending isn’t about cutting back on everything you enjoy; it’s about spending smartly and aligning your finances with your life goals. With goal-based investing, you can achieve the perfect balance between living in the moment and securing your future. Start today, and take the first step towards a financially free and fulfilling life.